A new report from USDA shows farms are taking on more debt but financial conditions have improved overtime.

Brad Zwilling with Illinois Farm Business Farm Management tells Brownfield it’s a trend he’s been closely following.

“In Illinois, we’ve gone from a little over $250,000 in 2004 up to over $1,000,000 in 2023,” he says. “It’s not because we borrowed money, but it’s because the assets that are behind those are really increasing. You look at the cost of machinery, the cost of land.”

USDA’s Agricultural Resource Management Survey found 23 percent of U.S. farms held debt in 2022. Large family farms had more debt than midsize and small family farms combined at nearly $2 million, compared to less than $240,000 for small family farms.

Zwilling says debt-to-asset ratios can vary widely across age groups and farm type.

“We see that those debt-to-asset ratios could be 40 to 50 percent for those younger farmers 30 or less,” he explains. “And then when you get over that 60 to 70, we may be looking at a 10 percent number.”

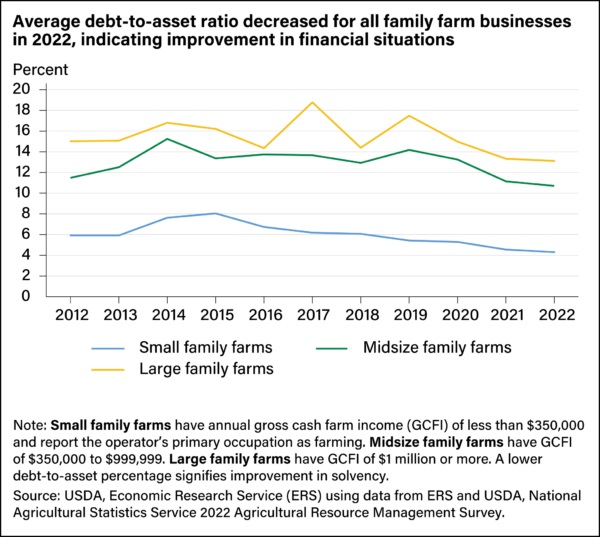

USDA says from 2021 to 2022, debt-to-asset ratios for all sized farms improved and remained lower than the 10-year average.

In 2022, mid-sized poultry family farm businesses had the highest debt-to-asset ratios, followed by small poultry family farms, midsized family hog farms, and large family dairy farm businesses.

Zwilling says livestock producers tend to have higher debt-to-asset ratios simply because they need more assets to operate.

AUDIO: Brad Zwilling, Illinois Farm Business Farm Management

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K