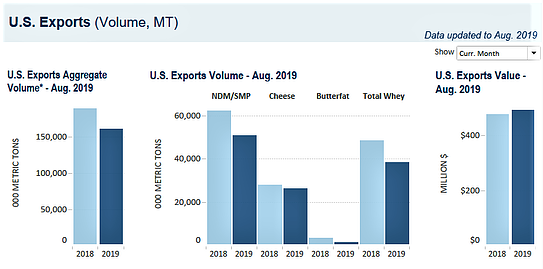

U.S. dairy export value was nearly $3.92 billion in the first eight months of 2019, up 3% from last year and the highest figure in five years. Gains were led by increased volumes of cheese, as well as higher selling prices for dairy ingredients.

In August, U.S. export performance was in line with recent months, with overall volume about the same as June and July. Still, these volumes lagged last August’s totals across most product categories.

Exports of nonfat dry milk/skim milk powder (NDM/SMP) were 50,993 tons in August, down 18% from a year ago. Sales to Mexico were off 23%, while shipments to the Philippines (-62%) and China (-91%) were also significantly lower.

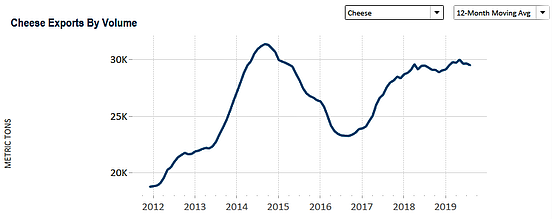

Since posting record export volume in March, U.S. cheese exports (on a 30-day-month basis) have declined five months in a row compared to the previous month, as strong domestic markets keep more U.S. product at home. Shipments in August were 26,595 tons, down 6% from a year ago. Sales to Southeast Asia were nearly a record high (2,811 tons, +127%), but lower exports to Australia (-46%), Japan (-42%) and South Korea (-12%) dragged down the total. In addition, sales to Mexico, though up 3%, were the lowest in 11 months.

Total whey exports were 38,722 tons in August, down 21% from last year. As has been the case all year, nearly all the decline can be attributed to lost sales to China from retaliatory tariffs and African swine fever. Suppliers sold just 5,430 tons of whey to China in August, down 63% and the lowest monthly figure in 19 years. These losses were only partially offset by record whey sales to Southeast Asia (12,129 tons in August, +6%).

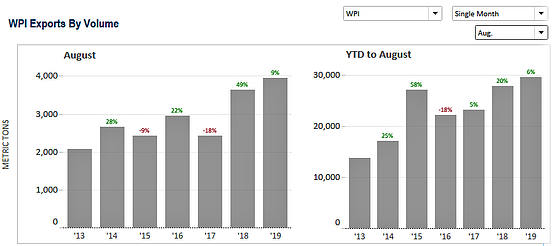

Within the whey complex, exports of whey protein isolate (WPI) were up 9% in August, and remain at a record pace for 2019, led by improved sales to the EU, Southeast Asia and South Korea.

Lactose exports dipped in August, falling 9% to 31,550 tons. Sales to China were down 40%, while shipments to New Zealand (-43%) and Japan (-31%) also were lower. Suppliers were successful in diverting some of these lost sales to Southeast Asia, where volume was up 36% for the month.

Exports of whole milk powder (WMP) spiked in August, reaching 6,216 tons, more than double last year, and the second-highest monthly figure in the last nine years. More than a third of the volume went to Algeria (vs. nothing last year), and Colombia and Peru also made larger purchases.

Shipments of fluid milk/cream stayed on a record pace, up 13% in August. Nearly 90% of the volume this year has gone to Taiwan, Mexico and Canada.

Among other products, exports of butterfat and food preps (blends) remained depressed in August, down 55% and 26%, respectively.

On a total milk solids basis, U.S. exports were equivalent to 14.2% of U.S. milk solids production in August. In the first eight months of the year, exports accounted for 14.1% of production.