They say they are owed more than $11 million by Westland but some will not receive a payout until 2023.

In the meantime they say they are effectively providing “an interest-free loan to a Chinese state-owned multi-national while they are left to struggle financially”.

“We’re helping fund the Chinese to buy Westland – interest free,” complained former shareholder Peter Williams, who left last year.

STUFF

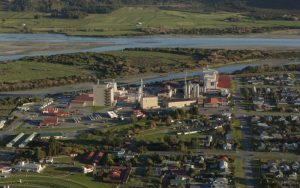

Potential buyer of Westland Milk Products, Yili, will pay top management generous bonuses if the sale succeeds.

The vote by shareholders to sell the co-op – the largest employer on the West Coast – is due to be held on Thursday.

Williams, who lives in Canterbury, said his group of six would go “as far as we need to go, we feel really strong about this”.

He did not rule out an injunction, and neither did lawyer Julie Crengle who is acting on behalf of the group.

The sale has been the subject of controversy because top management will collectively pocket well over $1m if the deal goes through. Chief executive Toni Brendish stands to receive $680,000, with other executive staff in line for payments from $100,000 to $360,000.

Chairman Peter Morrison has defended the payments against conflict of interest claims, arguing Westland board members would approve the deal, not management, and board members would get no benefit from the incentive scheme.

Williams accused Westland of being vindictive towards the former shareholders.

“It’s like bugger you, you left and you’ll have to wait five years for your money.

“There’s a provision in the Westland constitution which gives them the ability to defer the exiting shareholders’ capital for up to five years.

“That provision was put in essentially to protect the short term viability of the co-op. It’s like a provision to stop a run on the banks,” Williams said.

He said in the past the co-op had been a trusting environment where if the same amount of milk was coming in as exiting, they paid out immediately to former shareholders.

Last year Southern Pastures decided to join Westland, becoming the largest single shareholder, and the same amount of milk went in as came out.

Williams said Westland was ceasing to be a co-op, potentially owned by a very strongly capitalised foreign institution, part state-owned, “so we’re talking about a new set of rules”.

Chairman Pete Morrison said in a statement that if the sale proceeded the suppliers who had previously surrendered their shares in Westland would not be paid the $3.41 by Jingang – a subsidiary of Yili – as they would not be transferring any shares to Jingang.

Yili is a state-owned company which owns Oceania Dairy which operates near Waimate. It is China’s largest dairy producer.

Morrison described the former shareholders as unsecured creditors of Westland and recorded liabilities in Westland’s financial statements.

Crengle said Westland had confirmed last Friday its payments would remain the same, while Yili/Jingang had responded on Tuesday that it would be guided by Westland.

She said if the OIO did not step in, and an injunction was either decided against or did not succeed, the farmer shareholders would seek a judicial review of the OIO’s decision.