AHDB figures showed the gap between the highest and lowest milk price in 2019 was 9.34ppl, more than double that of the year before. Top of the league was Muller’s price for suppliers to Marks & Spencer.

The supermarket has been top in eight of the last 16 years, while Waitrose and Booths have topped the chart in other years.

League

At the bottom of the league last year was Buckinghamshire-based dairy Pensworth at 24.09ppl.

However, the gap between highest and lowest was not the largest seen. In 2015 it was almost 14ppl, with Meadow Foods producers being paid just 19.19ppl, compared to 32.92ppl for farmers supplying Booths.

Dairies who supply non-supermarket customers with liquid milk regularly appear towards the bottom of the league.

Dairy market analyst Chris Walkland said it was difficult for processors who over-rely on liquid sales in expensive to service markets.

“Those dairies have a fragmented customer-base in urban areas where it is getting more difficult to make deliveries,” said Mr Walkland.

Emission Zone

“This is especially the case in London which is expanding its emission zone charges over the next two years to cover more vehicles and a wider area.”

NFU dairy board chairman Michael Oakes said reform and investment were needed in the sector.

“It is clear the British dairy market is not working in the interests of a lot of producers,” said Mr Oakes.

“At a recent European dairy producer meeting, the Arla price of about 30ppl was the standard, not the exception.”

“In the long-term, there needs to be more investment in value-added processing and the Government has a role in encouraging that.

“However, this does little to comfort farmers who are facing a fall in prices which could see them losing 5ppl or more.

“I would urge more dairies to be more like Yew Tree Dairy, who has an open and transparent relationship with its farmer suppliers.”

Coronavirus pressure on milk prices

The immediate market outlook is weaker, with the global market hit by the coronavirus. Prices in the Global Dairy Trade auction have fallen 10 per cent since late 2019, with skimmed milk powder under particular pressure.

The February UK cream price was also 3.8 per cent lower than in January, according to AHDB.

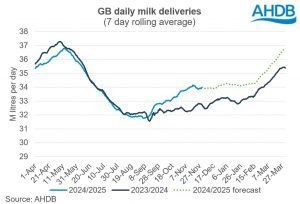

January milk production was at 1.244 billion litres, which was 1.7 per cent less than in January last year, according to Defra milk utilisation figures. Annual production to the end of January was 1.2 per cent more than the year before.

AHDB said production picked up from the middle of February. The mild winter means grass has been able to grow throughout winter despite heavy rainfall.

A number of dairies are holding their milk prices for April, including Paynes, Belton and First Milk.

Supermarket

Prices for aligned groups are falling, with a 0.61ppl drop for M&S Muller suppliers, which still leaves the standard at 32.72ppl, while a small drop in the Sainsbury’s price means Arla suppliers to the supermarket will get paid 30.58ppl and Muller 30.58ppl.

The 2ppl drop in the Cumbrian Meadow Foods price could mean some summer milk is sold for only 20ppl. Meadow has made the price drop because of the loss of sales to Arla.