Many surviving dairy producers say they felt a small swell of optimism over the holidays, even daring to hope for a much needed milk price recovery in the coming year.

While Mark Stephenson, agricultural economist and director of the Center for Dairy Profitability at the University of Wisconsin-Madison, is forecasting better milk prices for 2020, there could be some clouds blowing up on the horizon at the end of the year that could impact the dairy industry.

“We lost just over 10 percent of our dairy farmers from this state last year, so the accumulated five years of relatively low milk prices has a long tail on it. And even though my forecast for milk prices are better in 2020, I still think we’re going to see higher than normal farm losses continue this year,” Stephenson told listeners during a Hoard’s Dairyman Dairy Situation and Outlook for 2020 webinar on Jan. 13.

The most recently released data from the Wisconsin Department of Agriculture, Trade and Consumer Protection confirmed the trend, showing just 7,292 registered dairy herds remain in the state as of Jan. 1, a loss of 818 herds since 2018 — many of them driven out by the extended downturn. To make matter worse, for the third straight year, Wisconsin led the nation in farm bankruptcies in 2018.

Upward trends

Since then, Stephenson says several factors have played out across the dairy industry domestically and abroad to help milk prices gain traction once again.

Although milk production has begun to climb out of the cellar over the second half of 2019, Stephenson said it is still well below trend. As a result of decreased milk production across the country, storage inventories of dairy products began to shrink, helping prices to rise and subsequently strengthen milk prices.

Despite the strong economy, Stephenson says as an economist, he can’t ignore signs that the general economy may be slowing down.

“I think we’re at the top of the cycle and at a point where we can anticipate slower growth, at the very least, and possibly something like a recession,” he said. “But I don’t think that’s going to happen until we get past the election at the end of this year. But after that it’s going to be hard to hold that back.”

Stephenson says he hopes that consumer confidence and consumption will remain steady for the sake of the economy and the dairy industry. Although production of fluid milk has slowed, he says consumer demand for dairy products remains steady and has allowed for a reduction in inventories of whey powder, cheese and butter.

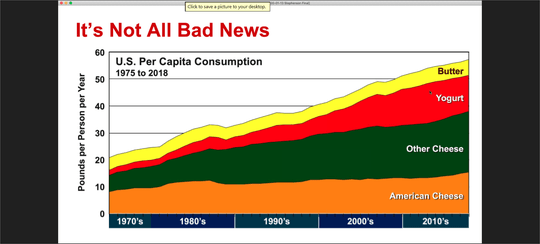

Among the commodities which have seen a resurgence in sales is cheese, which boasts a consumption rate of nearly 38 lbs/capita, double the amount consumed in the 1970s.

“If consumption (of goods) falls off, our economy will fall off too,” he said. “So, let’s hope that consumers stay reasonably confident about the economy.”

Since the 1970’s, cheese consumption has grown from around 14 lbs. per capita to an all time of high of 38 lbs. per capita. (Photo: Center for Dairy Profitability UW-Madison)

A player on the export stage

Now the world’s third largest exporter of dairy products, the U.S. has the task of competing against other big dairy producing countries such as the EU, New Zealand, Australia and Argentina, all of which have stepped up production over the years, vying for the same foreign markets.

Stephenson says what happens in those countries directly impacts the U.S., noting that milk production has not only slowed down here in the U.S., the trend is similar overseas. Drought conditions have plagued the EU for the past two years while New Zealand is wrestling with environmental constraints concerning animal density along with the effects of a mild El Nino.

“Milk production has slowed down worldwide, and I’m not sure that the EU or New Zealand can grow (production) significantly,” Stephenson said. “There are some countries with the resources to grow (that milk production) but I don’t think they’re going to do it next year.”

Stephenson also doesn’t expect to see a surge in milk production anytime soon in the U.S..

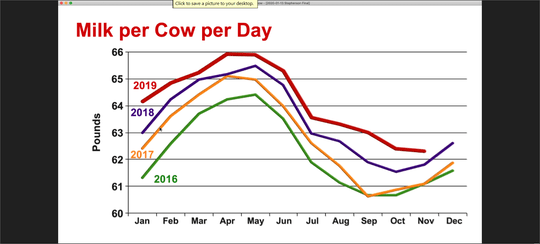

Although cow numbers have risen in response to stronger milk prices in the fourth quarter as farmers try to repair some of the damage to balance sheets, dairy economist Mark Stephenson said sustaining that milk per cow per day is going to be a challenge, with one of the factors being lower quality feed. (Photo: Center for Dairy Profitability UW-Madison)

“It really wasn’t until 2018 when persistently low milk prices began to bite at the farm level when we stopped just moving cows from one farm to another and began to lose dairy cows as a higher number of dairy farmers exited the business,” he said. “Although we’ve seen a response to stronger milk prices in the fourth quarter as farmers try to repair some of the damage to balance sheets, sustaining that milk per cow per day is going to be a challenge with some of the problems we’ve seen with feed.”

Large dairy producers that Stephenson has spoken with have intimated that they are not interested in expansion opportunities despite the more positive outlook in milk prices.

Opportunities and trade

Stephenson says prolonged trade negotiations have had a negative impact not only on the ag economy but the morale of farmers. According to Bloomberg News, Senate Majority Leader Mitch McConnell hinted that the Senate is expected to vote on the U.S.-Mexico-Canada Agreement this week. A final vote has not been confirmed.

Another long anticipated trade deal with China is expected to unfold this week when the Phase One Deal with China is signed on Wednesday. Many ag traders, analysts and farmers are anxiously waiting to see how the promised $40 billion in trade will benefit the different ag sectors.

Many remain skeptical as China recently stated it wouldn’t raise import quotas of certain U.S. commodities, saying it won’t take such action for just one country.

“I’m not sure what the (the trade deal) means yet, but I’ll be anxious to see whether there are specific provisions in there for dairy,” Stephenson said. “Historically they have purchased a lot of our whey products and I hope some of that is restored.”

While many see commodities of soybeans and corn as top trade priorities with China, Stephenson believes there is a great opportunity for dairy. He says over the years the country has seen a great deal of consolidation of their mid- to smaller dairy farms with the larger dairies “crawling” into production.

“They’ve actually had a loss in milk production as a result of this happening over the past couple of years, so they want and need dairy products,” he said.

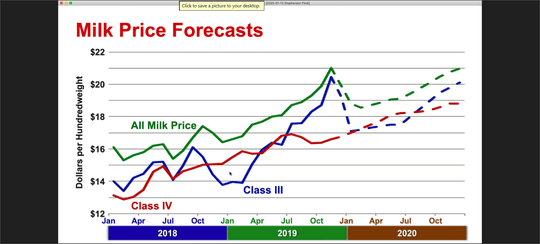

University of Wisconsin Dairy Economist Mark Stephenson says that absent a recession, milk prices in 2020 could break the $20/cwt. barrier. (Photo: Center for Dairy Profitability UW-Madison)

What’s ahead

Stephenson says he is predicting that the all milk price for 2019 will be up $2.35/cwt over the previous year and could still climb absent a recession at the close of the year. However, there are factors that could impact this as well.

“Markets have been up one day and down the next, and what everyone is looking for is that next piece of information that will tell them how much milk will be produced,” he said. “And that is likely to be the spring flush this year. If it’s a light flush I think we can expect buyers to bid prices up early and perhaps quite high. If it’s heavy, price strengthening will be slow for the rest of the year.”

Unfortunately the pain nor the exodus of farms from the dairy landscape is over. Stephenson said the dairy industry has experienced a fundamental structural change since 2015 and the decline will continue despite the uptick in milk prices.

“Even though milk prices are recovering, not all farms are going to be able to repair their balance sheets adequately to maintain themselves in the industry over the long run,” he said.

And if a recession enters the picture?

“Preparing for that is going to be much like farmers have done in the past. In the two years or so of better milk prices, pay down debts, pay off overdue bills that you’ve got to restore your balance sheets to the extent that you’re capable of and get yourself ready for a year or two of lower milk prices,” he said.