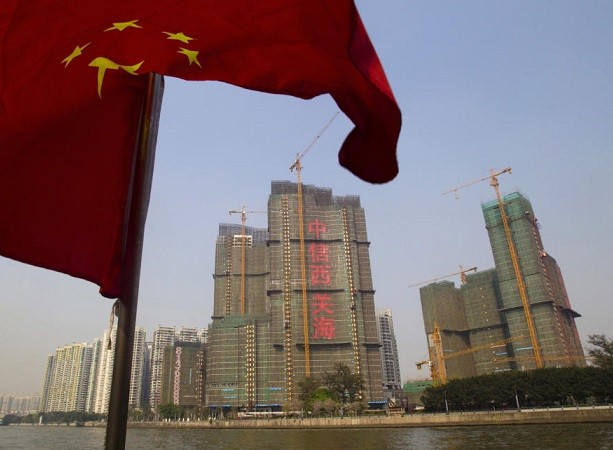

China July retail sales and industrial production increase growth was less than expected. Refinery output dropped, youth unemployment increased and average new home prices fell also weighed on commodities. All of this forced China Central Bank to unexpectedly lower 2 key interest rates in an attempt to shore up growth.

Fact forecast maps are in closer agreement that this week some of the driest areas of SD, ,E NE, W IA and MO will see good rains is offer resistance to futures. There are also rains in west EU.

Weak China economic data is weighing on corn futures. CZ could be in a 6.00-6.50 range until more is known about US 2022/23 supply and demand and Ukraine exports. USDA estimated US 2022/23 corn yield at 175.4 and carryout near 1,520 with key final yield and feed use.

US and EU rains and weak China economic data is offering resistance to soy complex futures. Dalian soybean, soymeal and soyoil prices were lower. SX could be in a 13.50-14.50 range until more is known about US 2022/23 supply and demand and China demand. USDA estimated US 2022/23 soybean yield at 51.9 and carryout near 245 with key final yield and crush demand.

Wheat futures are also lower. Higher US dollar and lower commodity prices may be weighing on wheat futures. WZ could be in a 7.50-8.50 range until more is known about Russia exports. USDA estimated US 2022/23 wheat carryout near 610 with key final US exports.