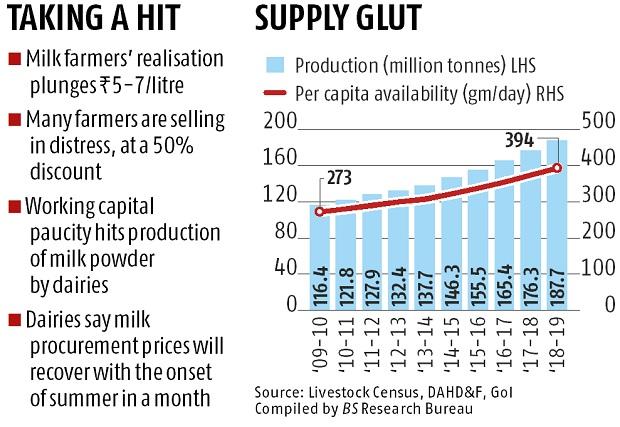

In a major setback to millions of farmers, India’s milk consumption has declined 25 per cent over the last month because of the closure of hotels, restaurants, and roadside tea stalls amid a nationwide lockdown to prevent the spread of coronavirus.

The decline in consumption has resulted in a Rs 5-7 per litre (or 25 per cent) decline in the realisation of dairy farmers. The milk market is flooded with surplus supply, with farmers at some areas selling in distress at a 50 per cent discount. Distress sales are happening in remote areas where private and co-operative dairies could not reach farmers for procurement because of disruption if transport services.

This scenario emerged after Covid-19 started spreading in major milk-producing states, such as Maharashtra, Gujarat, Karnataka, and Tamil Nadu.

While milk production is going on, the decline in consumption may dissuade farmers from making fresh investment in the upcoming season, as prices of milk derivatives like skimmed milk powder (SMP) have also crashed because of little exports amid the global pandemic.

“Milk consumption has declined 25 per cent over the past month because of the closure of hotels, restaurants, and roadside tea stalls. But, domestic consumption has increased. The closure of retail ice-cream parlours and other value-added products has contributed to the decline in milk consumption,” said R S Sodhi, managing director, Gujarat Cooperative Milk Marketing Federation (GCMMF), India’s largest dairy, which sells milk and its derivatives under ‘Amul’ brand.

On the other hand, household consumption of ghee, butter, and milk has increased as most people are home amid the ongoing countrywide lockdown. The increase in household consumption, however, is insufficient to compensate for the decline in overall milk usage. Household consumption contributes nearly 25-30 per cent of India’s overall milk usage.

Interestingly, dairies have not increased prices of these milk derivatives despite a spurt in their consumption.

“We are selling our products at the maximum retail price (MRP),” said Devendra Shah, chairman and managing director, Parag Milk Foods, the producer of ‘Go’ and ‘Govardhan’ brands milk products.

Meanwhile, the decline in overall consumption has prompted farmers to sell milk in distress, especially in remote areas of Maharashtra, Karnataka, Tamil Nadu, and Gujarat. Some farmers are offering milk to processors and private dairies at half the prevailing price of Rs 30-31 a litre.

According to Sodhi, large co-operative dairies are bound to pay farmers more because of their long term links with farmers. GCMMF pays Rs 31 a litre for cow milk and Rs 50 a litre for buffalo milk. Private and small co-operatives, by contrast, pay less in a supply glut situation.

“This is a temporary phenomenon — just a couple of weeks more. With the onset of summer, which is nearly a month away, milk supply will reduce and prices recover,” said Shah.

Normally, when milk supply is higher than consumer demand, dairies usually produce SMP or milk powder. “But, SMP prices have crashed because of reduced opportunity for exports. Shipments are halted and no orders are coming in. Despite the inadequate quantity of SMP available in the market, it is not feasible to convert excess milk into SMP and store it for supply in the peak demand season. Many dairies are facing working capital problem because of lack of funding from banks,” said Sodhi.

SMP prices in the domestic markets have declined to Rs 230 a kg, from Rs 310-320 a kg about a month ago. A similar trend is emerging in the international markets, where SMP prices slipped to $2,500 a tonne as against $3200 a tonne about a month ago.

Dairies, however, hope the decline in milk procurement prices will nullify squeeze in their profit margins, which was feared after lower sales of many products like curd, buttermilk, lassi, and ice creams.