For decades, legacy dairy cooperatives have dominated the southern states and made a profitable business selling milk. But with India’s largest dairy brand Amul’s new push to sell milk across five southern states, the dairy industry is headed for a possible shakeup.

Amul, which has been selling its other dairy products such as cheese and butter, will soon start selling around 30-40 lakh litres of milk across the region, making Andhra Pradesh its hub.

The aim is to get around ₹10,000 crore business, said RS Sodhi, managing director, Gujarat Cooperative Milk Marketing Federation, which sells its products under the Amul brand, in an interview. The company will invest ₹200-300 crore over the next two years for this purpose, he added.

“We started with the west, then went to north, and east… Somehow we had not gone to the south,” said Sodhi. “(But) we realise in the past 10 years, a lot of private players have come and some of them are not giving good prices to the market. So, we thought this is the best opportunity. Now if we don’t enter into the south, we will be losing and we will be giving a cakewalk to the other players.”

Amul currently has an annual turnover of ₹52,000 crore. Its quest into south Indian towns, which has seen an influx of out-of-towners from northern parts for work in recent times, will be a tale of the giant colliding with others, who were largely created by their own legacy.

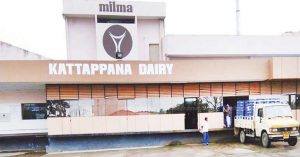

Popular regional dairy brands in the south— Karnataka’s Nandini, Kerala’s Milma and Tamil Nadu’s Aavin among others— were all once formed as farmers’ cooperatives emulating the roaring success of Amul.

Regional dairy cooperatives are however not sitting idle.

“Since we came to know that Amul is doing surveys in southern towns recently, we have been creating our own plans,” said Rajesh Nair, marketing manager at Milma, owned by Kerala Cooperative Milk Marketing Federation. Brands like Milma think the winner may be decided by marketing since there is no clear way to distinguish oneself in the milk business. “It has forced us to do bigger and newer ways to market ourselves. From spending ₹1-3 crore, we are now spending ₹10-15 crore on advertising. Soon, we are also empaneling a national agency for advertising,” he said.

The entry also foreshadows a political fight. The Andhra Pradesh government, led by chief minister Jagan Mohan Reddy, recently signed an agreement with Amul, extending support to start its milk business. The state’s dominant dairy company Heritage Foods Limited (HFL), a multi-crore enterprise, is run by the family of N Chandrababu Naidu, main political rival and predecessor.

Andhra Pradesh is already one of India’s largest milk-producing states, churning out an estimated four crore litres every day.

But before the winner is decided, the milky war promises to flood the streets with a lot of milk, and probably ice creams.

The company has done extensive surveys and has seen that there is also a good demand for milk-based products like ice cream, Sodhi said.

“Geographically, it (Andhra Pradesh) is a large market, which is connected to various good markets like Chennai, Hyderabad, Vizag. So, we thought we can make Andhra a hub and enter fresh markets of the south,” said Sodhi.

Nandini, owned by Karnataka Co-operative Milk Federation, has been aggressively increasing its presence. “It is now setting up more cafes, that serve coffee or tea or sweets or snacks made of milk-products to attract youngsters and highway riders,” said a person associated with the brand, requesting not to be named. The brand, he said, is also pinning its hopes on something that players like Amul cannot take away from it — government subsidies.

Sodhi disagreed that local cooperatives will suffer due Amul’s entry. “Wherever we have gone, we have seen that with our entry, local cooperatives have also flourished. It has impacted the small private players, who have exploited the gaps where the local cooperatives have not been able to reach. So, if we go to the south, it will complement the local cooperatives,” said Sodhi.