Amul, the country’s biggest milk brand, and its parent, the National Dairy Development Board (NDDB), have reiterated their staunch opposition to import from New Zealand and Australia.

This comes prior to an important meeting between the commerce ministry and dairy sector entities on the contentious negotiations regarding the proposed 16-nation Regional Comprehensive Economic Partnership (RCEP).

The latter is India’s most ambitious trade pact under negotiation. Based on India’s existing free trade agreement with the 10-country bloc of the Association of Southeast Asian Nations (Asean), the ambit will cover all major nations with which Asean has trade deals — China, India, Japan, South Korea, Australia and New Zealand.

Sources said NDDB chairman Dilip Rath has, in a letter to Union commerce secretary Anup Wadhawan and animal husbandry secretary Atul Chaturvedi, said any decision to reduce the tariff barrier would encourage import of cheaper milk powder. Which would put the livelihood of India’s dairy farmers at peril.

“Our country will be again pushed into a state of import dependence, jeopardising nutritional security,” goes the letter.

The meeting in question, officials said, is expected to be attended by senior representatives of domestic and multinational dairy companies in India. It has been called to solicit their views on RCEP negotiations and its implications.

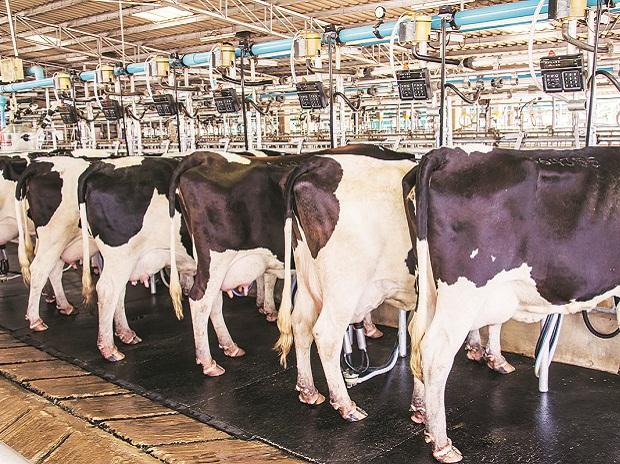

Under RCEP, tariff barriers on a host of items are expected to be lowered. The country’s dairy industry says it directly and indirectly supports tens of millions of farmers, the bulk being small and marginal ones.

New Zealand is the world’s largest exporter of milk and dairy products, accounting for a fifth of the global total at $5.4 billion in 2018, according to the International Trade Centre. India’s dairy sector says even 5 per cent of New Zealand’s dairy export is nearly 10 times India’s current import at $28 million. “In the last five-six months, milk prices have moved up from Rs 20-21 a litre to around Rs 31 a litre in the open market, while feed costs have risen from Rs 15 a kilogram to Rs 22.

Therefore, the production cost of milk is Rs 24-25 a litre, while the procurement price is Rs 31, allowing farmers to make some profits. If at this juncture cheap imports are allowed, the market will crash, devastating the livelihood of millions of farmers,” a senior industry official said. He said skimmed milk powder prices in international markets are Rs 160 a kg; in India, it is Rs 280-290 a kg.

“To make a kg of milk powder, you need 10 litres of milk. So, if cheap imports flood Indian markets, we would be forced to lower our procurement price by at least Rs 10-11 a litre, which would hurt farmers,” the head of a leading dairy firm told Business Standard.