The dairy sector in India grew at a compound annual growth rate (CAGR) of 10 per cent between 2014-15 and 2019-2020 as more players moved towards the organised from the unorganised market, global advisory firm o3 Capital has said in a report.

“As the world’s largest producer & consumer of milk & milk products, India contributes to 30% of the global milk production and a domestic consumption market of $94 billion. The sector has witnessed significant structural changes over the years, with consolidation being amongst the most notable theme,” the firm said.

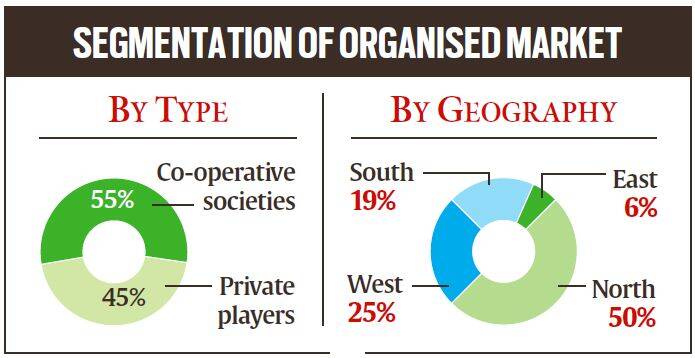

The share of private players in the dairy sector, which was 45 per cent by financial year (FY) 2019-20 to likely to further expand over the next five years to reach 50 per cent as consumer preference for higher quality and hygienic product increases. Going ahead, the opportunities for private sector dairy companies, will further increase with increasing per capita consumption of milk and consumer preference shifting towards value-added products rather than just milk, the report said.

“Liquid milk and traditional VAP (value-added products) fetch lower margins, however they deliver high RoCE (return on capital employed) due to limited investment in capex (capital expansion) and working capital. On the other hand, emerging VAP attract higher margins, however, fetch lower RoCE due to significant investment in capex,” the advisory firm said in its report.

The entry of newer players in the market in the private segment as well as current incumbents expanding the reach of their distribution networks in their core geographies is also likely to contribute to the expansion of private player dairy market, the report said.

Geography-wise, North India remained the largest producer of milk, accounting for 50 per cent of the total production of India, while the top ten states accounted for nearly 80 per cent of the milk and milk products made in the country.