Let’s look at the comparative analysis and root cause of both the situations of 2018 and 2020.

Situation in 2018

In mid-2018, Cooperatives (mainly GCMMF popularly known as AMUL) saddled with the stock of more than 150 thousand tonnes of Skim Milk Powder (SMP). During the same time, SMP rates in domestic market touched the rock bottom of Rs 130 per Kg due to distress sell by few players.

The situation was fuelled by many factors but the key factors are given below:

World Powder Market: It was hit by the lowest due to sluggish demand by the importing countries like China, Russia and other South East Asian countries. This led to reach the SMP price at Rs 135 per Kg internationally.

Milk Procurement by Private players: They stopped or reduced the milk procurement as they find it non-viable to convert the milk into powder and sell it domestically or in international market.

Milk Procurement by Cooperatives: They have received excess milk due to Private players’ decision and they responded lately to the flush procurement.

Election in Gujarat: Election commission had declared dates for assembly election in December 2017. Due to this, the cooperative dairies in Gujarat (having political hold) had increased/stable the milk procurement rates despite knowing what will be the consequences of this. Finally, this led to spurt in milk procurement by Gujarat cooperatives from within and outside Gujarat.

This led to the huge pile up of SMP with cooperatives (mainly GCMMF- had more than 100 thousand tonnes of SMP).

To do support in return, Government of Gujarat provided Rs 300 crore export subsidy (Rs 50 per kg) which allowed GCMMF to clear the excess stock of SMP to mainly neighbouring countries. This was the first time GCMMF took help from the State government to clear the SMP stock.

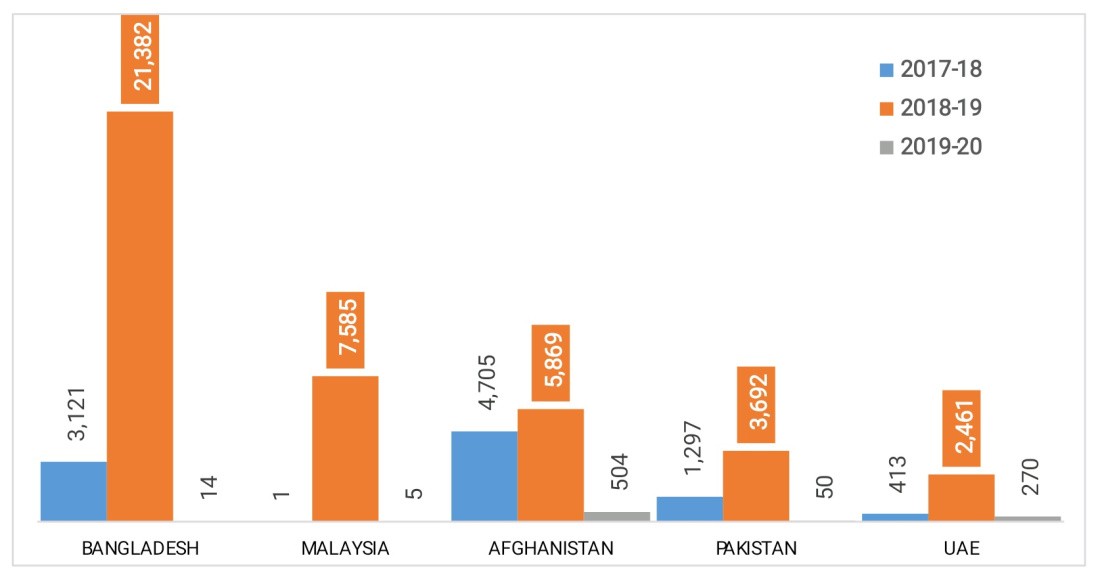

With the help of subsidy, India could able to export about 50 thousand tonnes of SMP in 2018-19. Of this 85% was exported to neighbouring countries (Bangladesh, Malaysia, Afghanistan, Pakistan and UAE).

Situation in 2020

Currently, India has burdened with more than 250 thousand tonnes of SMP, mainly cooperatives (of which Amul has more than 60%). The stock is almost twice than 2018 level. We need to remember that the situation was arose during flush months of 2018 while in 2020, it has happened during first 4 months of lean season.

The major factors are given below:

Covid-19: Due to stringent lockdown in the beginning, closure of HORECA business & Sweet shops and limited procurement by private players, the excess milk was procured by cooperatives.

Bottleneck in disposal of milk: Though the cooperatives had procured the excess milk but due to restricted movements in lockdown, the milk and milk products sale was hit hardest. The cooperative is forced to convert the excess milk procured into butter and SMP. Still the situation is improving but not reached normalcy.

Election in Gujarat cooperatives: As the election is going on in Gujarat cooperatives, the procurement price level is remain unchanged. Due to this, it may be possible that staus quo position will be maintained till Diwali (Nov-2020). This will also increase in the procurement levels in cooperatives and forced to convert surplus stock into SMP and Butter.

What’s next?

In a few media interviews, Mr Sodhi (MD, GCMMF) indicated the need of export subsidy so that the current stock situation can be eased. The both State and Central leaderships are yet to take any concrete steps to deal with the current stock condition.

After the election in different cooperatives of Gujarat will over (by Nov 2020), the procurement price will badly hit by the current inventory as Amul plays crucial role in benchmarking the prices at producer as well as consumer levels. This will have deep impact of the rural economy as dairying has been played important role in managing the day to day affairs where everyone is betting on Rural India.

Despite huge inventory with cooperatives, the SMP is trading at near Rs 200 per Kg locally as India is approaching big festive season in a short run. This gives us the hope that the situation may improve. Also the latest GDT auction rate of SMP (USD 2,889/MT translates into Rs 212/Kg ) shows hope for the improvement in the World Market and make India competitive. However, we have seen the decline of about 40% in the dairy export during the first quarter of financial year 2020-21.

The flush season is yet to start which is backed by good monsoon, sowing and abundance of fodder availability. This indicates that what we are currently facing is just a tip of iceberg.